About This Blog

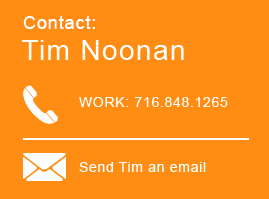

Noonan’s Notes Blog is written by a team of Hodgson Russ tax attorneys led by the blog’s namesake, Tim Noonan. Noonan’s Notes Blog regularly provides analysis of and commentary on developments in the world of New York and multistate tax law. Noonan's Notes Blog is a winner of CreditDonkey's Best Tax Blogs Award 2017.

Contributors

Timothy Noonan

Brandon Bourg

Mario Caito

Ariele Doolittle

Joseph Endres

Daniel Kelly

Elizabeth Pascal

Emma Savino

Joseph Tantillo

Craig Reilly

Andrew Wright

Stay Connected

Timothy P. Noonan

Timothy P. Noonan

Showing 158 posts by Timothy P. Noonan.

NY Tax Minutes: December Review and 2019 Preview

This article originally appeared in Law360 and is reprinted with permission.

It’s a new year here at “NY Tax Minutes,” but don’t worry, we’re still delivering all the month’s New York City and state tax news in a way that’s made for New Yorkers. Fast. But as we close the books on 2018 and look ahead to another year of tax updates, we’re adding a new wrinkle to this month’s column. We’re pulling out our crystal balls and predicting whether the news that brought 2018 to a close will continue into the New Year or whether we can turn the clock on these issues.

Recent Passthrough Entity Tax Credits and Other SALT Workarounds

As the calendar flipped to 2019, we’ve seen continued activity in states looking to find some way to combat the loss of SALT deduction to “help” its in-state taxpayers. The Tax Cuts & Jobs Act (“TCJA”) (P.L. 115-97) capped the individual state and local tax deduction at $10,000 per year beginning January 1, 2018, making it even harder for folks in high-tax states to stomach the payment of state and local taxes. To alleviate this burden, various states have offered up a myriad of “workarounds” usually in form of charitable contributions or new taxes designed to shift the tax burden from individuals (whose SALT deductions are capped) to businesses (which face no such cap). As we move into a New Year, let’s examine some of the recent developments.

Decoupling in New York Explained: New York Issues More Post TCJA Guidance

This promises to be the most “exciting” tax season ever for your friendly neighborhood accountants! It makes me a little relieved that I declined to follow in the footsteps of my father and grandfather (both CPAs) and turned to the legal world instead! With so many changes in the federal tax law, it’s going to be tough for accountants (and software companies) to keep up. And because most states’ tax laws are based on federal law or use federal tax rules as a starting point, so many of these federal changes will flow-through to state tax returns as well.

NY Tax Minutes: November

This article originally appeared in Law360 and is reprinted with permission.

We’re back with the fifth installment of “NY Tax Minutes.” And once again, we’re delivering all the month’s New York City and state tax news in a way that’s made for New Yorkers. Fast.

The SALT Cap Lawsuit Continues....

Earlier this month, those who oppose the SALT cap must have been pleased to see the results in the mid-term elections. With Democrats taking over the house, there’s already talk (here and here) that the next Congress will take aim at the cap. But quietly, on the other side of the battle lines, shots were fired by the federal government, as attorneys for the United States Department of Treasury and IRS filed a Motion to Dismiss the Complaint in State of New York, State of Connecticut, State of Maryland, and State of New Jersey v. United States Department of Treasury, The Internal Revenue Service and The United States of America, 18-cv-6427 on November 2 as noted here in the corresponding Memorandum of Law Supporting the Government’s Motion to Dismiss.

Wayfair Settles!

South Dakota Governor Dennis Daugaard and State Attorney General Marty Jackley announced on October 31, 2018 that the State of South Dakota has entered into a settlement agreement and stipulation of dismissal resolving all issues that had remained in the landmark Wayfair case. The settlement agreement and stipulation of dismissal were made with Wayfair Inc. and its co-litigants, Overstock.com Inc. and Newegg Inc., to resolve all remaining issues in South Dakota v. Wayfair Inc. State circuit court must still give its final approval to the settlement agreement reached by the parties and to the dismissal of both cases.

NY Tax Minutes: October

This originally appeared in Law360 and is reprinted with permission.

We’re back with the fourth installment of "NY Tax Minutes." And once again, we’re delivering all the month’s New York City and state tax news in a way that’s made for New Yorkers. Fast.

This month, we continue to chronicle New York’s response to the federal Tax Cuts and Jobs Act’s $10,000 cap on state and local tax deductions; we highlight important takeaways from the attorney general’s recent $30 million settlement announcement with a hedge fund manager in a tax whistleblower action; and we cover the tax department’s draft amendments to the state business corporation franchise tax regulations dealing with declaring and paying estimated taxes. We also highlight this month’s new and noteworthy decisions from the Tax Appeals Tribunal.

The Connecticut vs. New York “Convenience Rule” Battle: After 15 years, Connecticut Blinks!

Fifteen or so years ago, there was a debate brewing between Connecticut and New York about the so-called “convenience rule.” New York had the rule, so Connecticut residents working for New York employers were subject to it. But Connecticut didn’t have the rule, so Connecticut residents couldn’t get credit for taxes paid to New York against their Connecticut income tax liability.

NY Tax Minutes: September

This originally appeared in Law360 and is reprinted with permission.

We’re back with the third installment of "NY Tax Minutes." And once again, we’re delivering all the month’s New York state and city tax news in a way that’s made for New Yorkers. Fast.

This month, we revisit New York’s ongoing battle with the federal government over the recently enacted $10,000 cap on state and local tax deductions; we take a look at the importance of taxpayer testimony in domicile cases; we address the ever-growing list of non-audit related legal challenges facing taxpayers in New York state, including whistleblower lawsuits and class actions; and, lastly, we review New York City’s recent (better late than never) guidance on repatriated income for business taxpayers.

Some New York Highway Use Tax Registrations Are Being Improperly Targeted

The renewal period for Highway Use Tax registrations is just around the corner. The Tax Department, ever mindful of the leverage this affords, just sent out a slew of computer-generated notices that inform taxpayers with outstanding tax liabilities that the Department cannot issue them a renewed Certificate of Registration and decals until the liabilities are resolved.