About This Blog

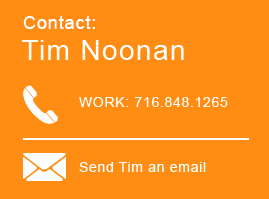

Noonan’s Notes Blog is written by a team of Hodgson Russ tax attorneys led by the blog’s namesake, Tim Noonan. Noonan’s Notes Blog regularly provides analysis of and commentary on developments in the world of New York and multistate tax law. Noonan's Notes Blog is a winner of CreditDonkey's Best Tax Blogs Award 2017.

Contributors

Timothy Noonan

Brandon Bourg

Mario Caito

Ariele Doolittle

Joseph Endres

Daniel Kelly

Elizabeth Pascal

Emma Savino

Joseph Tantillo

Craig Reilly

Andrew Wright

Stay Connected

Timothy P. Noonan

Timothy P. Noonan

Showing 158 posts by Timothy P. Noonan.

The Annual Report of the Division of Tax Appeals and Tax Appeals Tribunal

On October 17, 2017, the New York State Division of Tax Appeals and Tax Appeals Tribunal (collectively “DTA”) submitted its annual report to the Governor and heads of the Senate and Assembly for the 2016-17 fiscal year. Numbers-wise, we don’t see a tremendous change over last year in the outcomes of Administrative Law Judge and Tax Appeals Tribunal cases.

Drips and Drops on Taxing Hedge Fund Managers’ Deferred Comp

For years, there have been whispers about a big 2017 tax issue for hedge-fund managers. What’s the deal?

Market-Based Sourcing and Beyond: Be on the Lookout for New State Tax Issues in the Corporate Tax World

Just when you thought you knew everything there was to know about multistate corporate income tax apportionment, the states start switching up the rules!

Gaied Legislation Proposed for NYS Statutory Residency

Last Friday, members of the NYS Legislature introduced a bill aimed at clarifying the definition of “permanent place of abode” under Tax Law § 605(b)(1)(B) for statutory residency purposes. Under that statute, a person is generally taxable as a resident if they meet a two-pronged test: (1) maintain a “permanent place of abode” in New York and (2) spend more than 183 days in New York.

New York Tax Powers of Attorney: There’s an App for That…and a New Form

For years, practitioners and taxpayers have struggled with the cumbersome, four-page power-of-attorney form that the New York Tax Department has required taxpayers to use when they wanted to appoint a representative to help them with their tax matter.

But this week, the NYS Tax Department rolled out a new web application where POAs can be filed online.

Love Conquers All in New York Domicile Case

Last week, another great domicile case was issued by New York’s Division of Tax Appeals. The case, entitled Matter of Patrick, chronicled a movie-esque love affair between long-lost high school sweethearts and—more importantly for our purposes—another win for a taxpayer in a change-of-domicile case. We also covered this case in our TiNY Blog.

New Tax Department Sales Tax Ruling Issued on Club Dues and Sports Activities

The New York State Department of Taxation and Finance has issued a new sales tax ruling on the taxability of club dues at a social club. In an advisory opinion released May 24, tax department held that fees charged to nonmembers for club-sponsored activities are not subject to tax merely as a result of the club’s relationship to its members and that the nature of each activity should determine its taxability. The ruling was also written up in a recent Tax Notes article, in which yours truly was quoted.

Another Cloud-Computing Ruling Descends from the Tax Department

Last week the Tax Department published another advisory opinion on a “software as a service” issue, continuing the trend of rulings on software sales “in the cloud.” A few years ago, I wrote an article on sales tax issues in the cloud-computing context generally, and we have also covered New York cases where the issue has come up. In this most recent opinion, the taxpayer asked whether charges for its “video generating services” were subject to sales tax. And not surprisingly, the Department concluded that the sales were taxable, continuing its trend of taxing almost everything that moves in the cloud.

New York State Tax Department Again Tries to Tackle Federal Issues

During the past several years, we have seen a continuing trend in New York personal income tax audits involving the examination of federal tax issues. The New York State Tax Department, overall, has one of the more sophisticated and aggressive personal income tax audit groups in the country. For years, as I have outlined in numerous blogs and articles, the Tax Department’s residency audit program has been second to none. But as we have seen, the Tax Department focuses more on flow-through entity issues. We also have seen the expansion of an interesting phenomenon: federal tax audits being conducted by New York tax auditors.

Discovery Continues in Sprint Whistleblower Litigation

Here’s a note on an interesting development in the ongoing litigation between the Tax Department and Sprint. For background, Sprint has been embroiled in the false claims action brought by New York State as a result of allegations that Sprint knowingly under-collected sales tax on bundled charges to New York cellular customers. When the case was brought several years ago, it was the first big false claims case brought by the State under the new False Claims regime that included tax violations under its realm. Sprint unsuccessfully tried to dismiss the lawsuit altogether, but a couple of years ago New York’s Court of Appeals held that the action could continue.