About This Blog

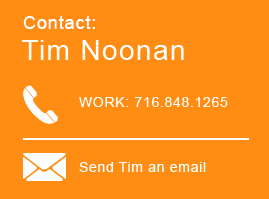

Noonan’s Notes Blog is written by a team of Hodgson Russ tax attorneys led by the blog’s namesake, Tim Noonan. Noonan’s Notes Blog regularly provides analysis of and commentary on developments in the world of New York and multistate tax law. Noonan's Notes Blog is a winner of CreditDonkey's Best Tax Blogs Award 2017.

Contributors

Timothy Noonan

Brandon Bourg

Mario Caito

Ariele Doolittle

Joseph Endres

Daniel Kelly

Elizabeth Pascal

Emma Savino

Joseph Tantillo

Craig Reilly

Andrew Wright

Stay Connected

Timothy P. Noonan

Timothy P. Noonan

Showing 158 posts by Timothy P. Noonan.

Pass-through Entity Level Taxes - Where are They and How do they Work?

The SALT cap has been in the news since the Tax Cuts & Jobs Act (TCJA - P.L. 115-97) was passed in late 2017, with federal legislation capping the individual state and local tax deduction at $10,000 per year beginning January 1, 2018. SALT cap issues have abounded and we have written about SALT lawsuits here, proposed workarounds here, and new IRS regulations regarding SALT credits here. Of course, the biggest hurdle facing taxpayers still remains finding a viable workaround to the SALT cap.

NY Tax Minutes: City Finances, Transparency, Tribunal Rulings

This article originally appeared in Law360 and is reprinted with permission.

August is often a slow month in the state and local tax world, with attorneys, accountants and auditors looking to squeeze the last bit out of summer. But not everyone at the New York State Tax Department took a break this month. And our most seasonally appropriate update comes from the Tax Department’s August appearance at The Great New York State Fair in Syracuse, New York. [1]

New York State v. Obus : Clearing the Air on a New N.Y. Tax Case

There has been a lot of buzz in recent days about a recent New York Division of Tax Appeals case addressing the New York residency status of a taxpayer who maintained a vacation home in New York state. The case, titled Matter of Obus, dealt with a New Jersey resident who worked in New York City and also maintained a vacation home in Northville, New York, a vacation community in Upstate New York. The case was also covered in a Wall Street Journal article that has sparked a lot of confusion about New York’s residency tests.

NY Tax Minutes: Trump Tax Returns, New Corporate Tax Regs

This article originally appeared in Law360 and is reprinted with permission.

Every year, magazines and newspapers across the country release summer’s best beach reads — lists of what books and articles to pick up and read your way through vacation. But, if you’re like us, don’t you wish there was a list tailored just for tax professionals? Those of us looking for something relaxing to read on our summer vacations but that’s also tailored just for you? Well for that, there’s only one recommendation you need: this month’s edition of NY Tax Minutes.

Are Tax Rates Going Up In New York?

All the talk around the SALT Cap over the past year or so has put New York’s high personal income tax rates into focus. Just last month, President Trump locked into a Twitter debate with Governor Andrew Cuomo, arguing that "it is very hard and expensive to live in New York" because of the state's "ridiculously high taxes.” Governor Cuomo countered that he had in fact lowered taxes. Whatever the case, with the SALT Cap hurting high-income New Yorkers, one obvious way to alleviate that burden would be to reduce state income tax rates. Even a little bit would help!

Five Organizations File Amicus Briefs Urging the Supreme Court of the United States to Hear Taxpayers' Lawsuit

On June 24, Hodgson Russ LLP filed petitions for certiorari with the Supreme Court of the United States (“the Supreme Court”) in two cases involving the double taxation of taxpayers who lived in another state but were “statutory” residents of New York because they had a place to live in New York and were in New York 183 days or more. The cases are titled: Samuel Edelman and Louise Edelman, Petitioners v. New York State Department of Taxation and Finance, et al. (“Edelman”) and Richard Chamberlain and Martha Crum, Petitioners v. New York State Department of Taxation and Finance, et al. (“Chamberlain”).

More SALT Deduction Lawsuits!

As we reported here a month ago, the IRS never liked the SALT cap workarounds that allowed taxpayers to receive a tax credit for contributions to specified state charities. Last month, it issued final regulations that officially, in the IRS’ mind at least, shut down these programs as workable workarounds.

New York Tax Minutes: Final SALT Regs and 2 Post-Budget Changes

This article originally appeared in Law360 and is reprinted with permission.

The Fourth of July fireworks may be over but there’s still plenty to see on the New York tax front. In this month’s edition of NY Tax Minutes, we take a look at the Internal Revenue Service’s final state and local tax, or SALT, regulations addressing potential workarounds to the SALT deduction cap. We also highlight two noteworthy post- budget changes to New York’s tax law and look in on the past month’s important state tax decisions and opinions.

NYS Offers a GILTI Exemption and Increases its Economic Nexus Threshold

On June 20, 2019, both the NYS Assembly and Senate passed bills that made significant changes to the state’s treatment of two hot tax issues: the taxation of global intangible low-taxed income (“GILTI”), and the state’s threshold for establishing economic nexus for sales tax purposes. According to the Senate and Assembly websites, the legislation was signed into law by Governor Cuomo on June 24th.

Report on Connecticut Biennial Budget FY 2020-2021

On June 4, 2019, Gov. Ned Lamont announced that Connecticut’s Democrat-controlled Assembly passed the $43.35 billion FY 2020 Budget (the “Budget Plan”). The Final Bill (H.B. 7424) which cleared the Senate on June 4 and the House on June 3, is available here. It aims to resolve a $3.7 billion multi-billion dollar deficit largely through tax and revenue hikes, increasing spending by 1.7% in fiscal year 2020 and by 3.4% in 2021. As of June 13, it has not been signed by the Governor. This is just a formality as he stands behind this Budget Plan.