About This Blog

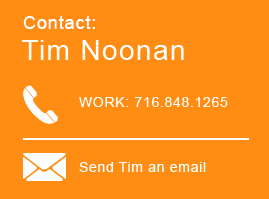

Noonan’s Notes Blog is written by a team of Hodgson Russ tax attorneys led by the blog’s namesake, Tim Noonan. Noonan’s Notes Blog regularly provides analysis of and commentary on developments in the world of New York and multistate tax law. Noonan's Notes Blog is a winner of CreditDonkey's Best Tax Blogs Award 2017.

Contributors

Timothy Noonan

Brandon Bourg

Mario Caito

Ariele Doolittle

Joseph Endres

Daniel Kelly

Elizabeth Pascal

Emma Savino

Joseph Tantillo

Craig Reilly

Andrew Wright

Stay Connected

Decision Issued in Chamberlain v. NYS, the First “Wynne Challenge” to New York’s Statutory Residency Scheme

Last year, we filed a lawsuit on behalf of Richard Chamberlain and Martha Crum against the New York State Tax Department, alleging that New York’s statutory residency scheme improperly subjected them to double taxation in violation of the Federal Commerce Clause.

New Detroit “Jock Tax” Guidance: Nothing Really to See Here

New income tax guidance has been released by the City of Detroit, aimed specifically at professional athletes. The guidance clarifies how professional athletes should apportion their income to Detroit for purposes of its city income tax.

New Sales Tax Case Highlights “Form over Substance”

Matter of CLM Enterprises illustrates the long-established rule that form always wins over substance in the sales tax area. The taxpayer was a holding company that owned several car dealerships, all as single member LLCs, which are disregarded for income tax purposes but NOT sales tax purposes. The issue in the case concerned how it was treating loaner cars. For several administrative and liability reasons, the group decided that all loaner cars should be titled to the taxpayer. The loaner cars initially were acquired by the dealerships, but then were transferred by the dealerships to the taxpayer. No cash changed hands, however. This was not a “sale” in the ordinary context. Whatever the case, when customers used the loaner cars, expenses associated with this were allocated to the respective dealership.

Executive Budget Proposed

Governor Cuomo’s proposed budget legislation for fiscal 2017-18 was released on January 18, 2017. In his briefing that evening, the governor remarked that one of the “main aspects of this budget is tax policy.” That’s certainly one way to captivate the attention of tax practitioners!

New Security Safeguards for the 2017 Filing Season

The NYS Tax Department’s ongoing efforts to combat identify theft and deter fraud have yielded a new requirement for this filing season. Beginning with the 2016 tax year, all e-filed personal income tax returns must provide certain information from the taxpayer’s state-issued driver’s license or non-driver ID.

Tax Appeals Tribunal Throws a Curveball in Empire Zone Case

Late last week the Tax Appeals Tribunal issued a decision (in Matter of Purcell) reversing several prior Administrative Law Judge determinations on a technical issue related to the calculation of the tax reduction credit that was available in the old Empire Zone Program. I actually covered this issue several years ago in a Noonan's Notes article. And though that alone doesn’t make this very exciting, the case is noteworthy given that the tax department had lost as many as 4 cases at the Administrative Law Judge level over the past several years on this issue, and undoubtedly has probably settled several others favorably for taxpayers. The Purcell case goes in the exact opposite direction as all these prior cases, and holds that the tax department’s methodology for computing this “tax reduction credit” was reasonable.

Report from the First Annual New York State Tax Summit

Last week we had the opportunity to attend the first annual New York State Tax Summit, a daylong seminar put on by the New York State Department of Taxation and Finance at their offices in Brooklyn. It was a fantastic event, with senior Department officials presenting a wide variety of topics and issues for discussion. There were close to 200 attendees present. And the Agenda was impressive. Here are some of the highlights of the day:

Breaking Up Is Hard to Do: New York Report on High-Income Nonresidents in the New York Economy

Breaking up is hard to do. Or so the old Neil Sedaka song goes. And a new report from the New York City Comptroller’s Office suggests that when it comes to the love affair between New York City and the country’s highest-income earners, the song rings true.

Potential Tax Breaks for Web Designers and Software Developers

The New York State Department of Taxation and Finance issued a press release on September 26, reminding website designers and software developers of a sales tax exemption and warning them not to “miss out.” According to the press release, no state or local sales tax will be charged on the purchase of computer system hardware when it’s used more than 50% of the time to:

- Design and develop computer software for sale;

- Provide website design and development services for sale; or

- Provide a combination of the two uses described above.

More Sales Tax News in the FCA Area: IL Whistleblower Finds Success in NY

Chicago lawyer Stephen Diamond has made quite a name for himself in recent years for his perceived abuse of the Illinois False Claims Act (“FCA”). Many believe Diamond is misusing the FCA or is using it for self-serving reasons not consistent with the FCA’s intent.