About This Blog

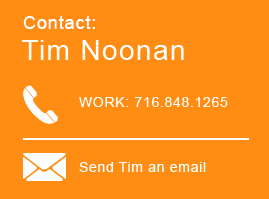

Noonan’s Notes Blog is written by a team of Hodgson Russ tax attorneys led by the blog’s namesake, Tim Noonan. Noonan’s Notes Blog regularly provides analysis of and commentary on developments in the world of New York and multistate tax law. Noonan's Notes Blog is a winner of CreditDonkey's Best Tax Blogs Award 2017.

Contributors

Timothy Noonan

Brandon Bourg

Mario Caito

Ariele Doolittle

Joseph Endres

Daniel Kelly

Elizabeth Pascal

Emma Savino

Joseph Tantillo

Craig Reilly

Andrew Wright

Stay Connected

New Jersey Income Tax Planning Opportunity: Delaware Trusts

A significant benefit of using trusts is the ability to minimize state level income taxes. The availability of this strategy depends on the residence of the trust creator (the “settlor”); the residence of the trustee; the residence of the trust beneficiaries; the type of assets owned by the trust; and the type of income earned by the trust. When all of the factors align correctly, the trust settlor can minimize, or even eliminate, state level income tax on the trust assets.

Federal Court Rules Refunded NYS Brownfield Tax Credits Are Taxable Federally

New York’s Brownfield Cleanup Program (“BCP”) is one of the more effective tax-based incentive programs offered by the state. The BCP allows participants to remediate a contaminated piece of real property in exchange for tax credits that can total up to 50% of the qualified remediation costs incurred to clean the property, and 24% of the qualified construction costs incurred to develop the property after it has been remediated. These tax credits can be the difference between a lucrative development and one that is economically unfeasible.

A Two Percent Property Tax Cap But No Pied-A-Terre Tax in New York: Gov. Andrew Cuomo's Recently Released Fiscal Year 2020 Budget

https://www.hodgsonruss.com/practices-State_Local_Tax.htmlGovernor Cuomo announced that New York lawmakers passed the $175.5 billion FY 2020 Budget (the “Final Bill”) on April 1, 2019. There’s a lengthy list of spending packages in the budget as described here but I’m circling back to two real property tax issues. Although Gov. Cuomo floated the idea of a pied-a terre tax on large mansions which I wrote about here, and an increased real estate transfer tax on conveyances where the consideration “for the entire conveyance” is $5 million or more, which my colleagues wrote about here, neither of these items made the final cut. Instead, the budget features: a permanent property tax increase cap of 2% and a “mansion tax,” a variation of the proposed pied-a terre tax. The State Assembly and State Senate on March 31 approved the budget’s revenue bill (S. 1509-C/A. 2009-C) soon after legislative leaders and Gov. Andrew Cuomo reached an eleventh-hour agreement on the state budget, one day before the start of the fiscal year.

Report on Executive Budget FY 2020

On April 1, Governor Cuomo announced that New York lawmakers passed the $175.5 billion FY 2020 Budget (the “Final Bill”). The Final Bill (S. 1509-C / A. 2009-C) is available here. As of this writing, it has not been signed by the Governor. We have been following the evolution of the budget since Governor Cuomo released his proposal on January 15th, which we covered here. The tax and revenue highlights of the Final Bill, along with the omissions or differences from the Governor’s original proposals, are summarized below. Other aspects of the Final Bill, including criminal justice reform, MTA reforms, and changes to the Public Authority Law, are not discussed.

New York’s High Court Halts Wynne Challenges

Last week, New York’s highest court issued a disappointing blow to our New York “Wynne challenges,” the two cases brought to challenge the double taxation scheme that applies to taxpayers who are dual residents in New York and another state. In both cases, Chamberlain and Edelman (previously covered here), we argued that the U.S. Supreme Court’s 2015 decision in Comptroller v. Wynne upended New York’s prior precedent on this issue (Tamagni v. Tax Appeals Tribunal). But the Court declined to hear the taxpayers’ appeals from the lower court decisions, and did so by way of two two-sentence orders with no analysis or explanation.

NY Tax Minutes: Marketplace Sales Tax, Corp. Franchise Regs

This article originally appeared in Law360 and is reprinted with permission.

As we finalize this month’s column, it appears that budget season here in New York state has finally come to a close, with the Governor and Legislature agreeing, on March 31, 2019, to a new $175 billion budget. The agreement came one day before the deadline for an on-time budget in order to meet the state’s next fiscal year, which begins April 1 In a March 31, 2019 press release,[1] Gov. Andrew Cuomo, Senate Majority Leader Andrea Stewart-Cousins and Assembly Speaker Carl Heastie announced a plan that includes:

Decoupling for Trusts and Estates and Other Disallowances Included in Last Minute Revisions to Budget Bill

On March 31st an agreement was announced on the FY 2020 Budget. We wrote about the tax related highlights of the budget proposal when it was released back in January. We also recently commented here about the mismatch between the treatment of itemized deductions for individuals versus trusts. Recent guidance from the Tax Department clarified that individuals could itemize deductions at the state level even if they took the standard deduction on their federal return and could take deductions for items disallowed at the federal level. Initially, this seemed to only apply to only individuals, and not trusts and estates.

New York’s SALT “Workarounds” Not Really Working

Now in the heart of tax season, we are reminded about many of New York’s tax credits and deductions still available to taxpayers despite federal deductions being eliminated with the passage of the Tax Cuts and Jobs Act (TCJA) in December 2017. Over the past year, there has been a flurry of activity as New York legislative bodies and federal regulations drafters have offered up various SALT “workarounds,” to deal with the $10,000 SALT cap. But recent reporting out of the New York budget office (from New York State Comptroller Thomas P. DiNapoli’s February 27 report on the proposed executive fiscal budget for 2020 (the “Report”) (see page 25-26)) suggests that these workarounds aren’t really working.

Mismatch for Decoupling in New York: Trusts and Estates Not Covered!

A few months ago, we wrote about the recent guidance that the Tax Department issued about itemized deduction decoupling (TSB-M-18(6)). The guidance addresses New York State’s decoupling from the federal treatment of deductions for individuals, but it was not initially clear whether these changes also apply to trusts and estates.

New York’s Potential New Pied-a-terre Tax and Expanded Real Estate Transfer Tax: Nuts and Bolts of the Proposed Law

As reported here last month, a recent purchase of a $238 million apartment in New York City has re-sparked a debate among New York officials about taxing second homes owned by nonresidents. As New York’s lawmakers look to finalize a budget by April 1st, and to find new ways to fund New York City’s subway system, the pied-a-terre tax is viewed as a new quill in the arsenal. (The Assembly Budget Proposal is A. 2009-B).