About This Blog

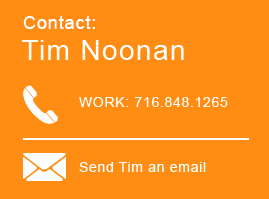

Noonan’s Notes Blog is written by a team of Hodgson Russ tax attorneys led by the blog’s namesake, Tim Noonan. Noonan’s Notes Blog regularly provides analysis of and commentary on developments in the world of New York and multistate tax law. Noonan's Notes Blog is a winner of CreditDonkey's Best Tax Blogs Award 2017.

Contributors

Timothy Noonan

Brandon Bourg

Mario Caito

Ariele Doolittle

Joseph Endres

Daniel Kelly

Elizabeth Pascal

Emma Savino

Joseph Tantillo

Craig Reilly

Andrew Wright

Stay Connected

Online Marketplaces Must Now Collect Sales Tax in New York State

Public relations firms often advise clients to release controversial or negative news late in the day on Friday. People are less likely to pay attention to such news over the weekend and by the time Monday rolls around, the news cycle has typically moved on. That might have been what the New York State Department of Taxation and Finance had in mind when, at 4:39 PM on Friday, March 9th, it released its first sales tax advisory opinion of the year. In TSB-A-19(1)S, the Tax Department announced for the first time that an online marketplace can be held liable for the sales tax due on transactions that the marketplace facilitated. In other words, the Tax Department can hold both the individual vendor using the marketplace infrastructure and the marketplace itself liable for tax due on sales made through the marketplace. This is a dramatic, and we anticipate controversial, change in Tax Department policy.

NY Tax Minutes: Amazon, Congestion Pricing, GILTI Guidance

This article originally appeared in Law360 and is reprinted with permission.

The past month was a busy one for New York tax updates, but don't worry, we have the highlights, and, as always, we're delivering the month's news in a way that's made for New Yorkers. Fast.

Can New York Continue to Ignore the Wynne Case?

Is New York’s taxation of statutory residents unconstitutional? Those who follow state and local tax developments (and readers of this blog) may know that Hodgson Russ has been litigating that question in two parallel cases, Chamberlain and Edelman (past coverage here and here). Both cases hone in on whether the U.S. Supreme Court’s 2015 decision in Comptroller v. Wynne upends New York’s prior precedent on this issue in Tamagni v. Tax Appeals Tribunal, requiring a new constitutional analysis. We think so, and that under an analysis consistent with Wynne, the double taxation faced by people domiciled outside of New York but taxed as statutory residents unconstitutionally burdens and discriminates against interstate commerce.

A Pied-à-terre Tax in New York City?

According to a recent New York Times article, hedge-fund billionaire Kenneth C. Griffin purchased a $238 million apartment in January 2019 located at 220 Central Park South, making it the most expensive residential sale in United States history. Even in Manhattan, where huge real estate sales are downright routine, Griffin, founder and chief executive of the global investment firm Citadel, has managed to set a new record on an unfinished piece of property, a purchase that surpassed the cost of the next most expensive purchase by more than $100 million.

Sports Team Owners Strike-Out with Pass-Through Deduction

This article originally appeared in Law360 and is reprinted with permission.

Much of the fanfare around last year’s federal tax reform was around the special 20% deduction applicable to income from flow-through entities like partnerships, S corporations and LLCs under IRC § 199A. But the new law generated more questions than answers, requiring the IRS to issue new regulations to help taxpayers and practitioners sort through all the details. Just recently, the IRS issued final regulations, and they came with some bad news for owners of your favorite sports team. Specifically, the new regulations confirm that sports team ownership falls within the definition of “athletics” and, therefore, is a disqualified activity, meaning team owners generally will be unable to qualify for the 20% deduction with respect to income generated from the team. In this post, we’ll explain what all the fuss is about.

NY Tax Minutes: Wayfair, Executive Budget, Goldman Offshore

This article originally appeared in Law360 and is reprinted with permission.

The New Year is in full swing here at “NY Tax Minutes,” and we’re sticking with our resolution to deliver all the month’s New York City and state tax news in a way that’s made for New Yorkers. Fast.

Hot off the Press: New NY Tax Proposals in 2020 Budget

On January 15th, Governor Cuomo released the FY 2020 Executive Budget, which is available here. The highlights of certain proposed revenue provisions are summarized below. Keep an eye out for further updates in mid-February when the “thirty-day amendments” to the Executive Budget will be out.

New York Finally Issues Guidance on Sales Tax Economic Nexus

New York is one of the most, if not the most, aggressive states when it comes to tax enforcement. That’s why it was a bit confusing when the New York State Department of Taxation and Finance (the “Tax Department”) remained uncharacteristically silent following the landmark Supreme Court decision in South Dakota v. Wayfair. But that’s finally changed! On January 15, 2019, the Tax Department issued a Notice explaining its position on economic nexus for sales tax purposes. In this article, we’ll (1) provide a brief review of how the Wayfair case changed tax administration, (2) discuss New York’s new guidance, and (3) address some of the potential issues that are likely to arise as a result of this new guidance.

NY Tax Minutes: December Review and 2019 Preview

This article originally appeared in Law360 and is reprinted with permission.

It’s a new year here at “NY Tax Minutes,” but don’t worry, we’re still delivering all the month’s New York City and state tax news in a way that’s made for New Yorkers. Fast. But as we close the books on 2018 and look ahead to another year of tax updates, we’re adding a new wrinkle to this month’s column. We’re pulling out our crystal balls and predicting whether the news that brought 2018 to a close will continue into the New Year or whether we can turn the clock on these issues.

Recent Passthrough Entity Tax Credits and Other SALT Workarounds

As the calendar flipped to 2019, we’ve seen continued activity in states looking to find some way to combat the loss of SALT deduction to “help” its in-state taxpayers. The Tax Cuts & Jobs Act (“TCJA”) (P.L. 115-97) capped the individual state and local tax deduction at $10,000 per year beginning January 1, 2018, making it even harder for folks in high-tax states to stomach the payment of state and local taxes. To alleviate this burden, various states have offered up a myriad of “workarounds” usually in form of charitable contributions or new taxes designed to shift the tax burden from individuals (whose SALT deductions are capped) to businesses (which face no such cap). As we move into a New Year, let’s examine some of the recent developments.